- June 18, 2024

- Posted by: Jackson Bennett

- Category: News

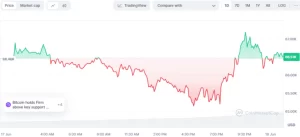

Today, the price of bitcoin has risen to $67,252 after revisiting the earlier low point of $65,088, where it had been plunged into a bearish trend; however, there was a bounce-back that followed. At the moment, BTC’s resistance is too strong for a bullish market.

Bitcoin’s Dominance Surges

The dominance of Bitcoin continues to rise as capital outflows from cryptocurrencies.

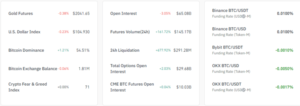

BTC futures trading rises 149.73%, with trades worth $141.79 billion.

Over the past day, Bitcoin (BTC) has tested its resistance at $67 252 after falling to intraday support at an all-time low of $65 088. However, this momentum could not be sustained because this resistance mark proved unbreakable for bulls.

Read more:- Is Regulation Coming For Bitcoin?

Increased Share of Bitcoin in Market Capitalization

Accordingly, the bitcoin dominance index, which shows proportionate amounts invested into bitcoins from entire altcoin markets by investors, increased by 0.91% over those few hours, up to 54.34%. This depicts a situation whereby, despite other investments, there is more capital flowing into it.

In the current market environment, which higher expectations or a hedge against volatility characterize, among others, some investors might view Bitcoin as safer than other asset types.

At 71, the level of the Crypto Fear & Greed Index shows that there is rampant greed in the market. Market corrections have been observed at such levels in the past when excessively bullish investors are brought back to earth. However, increased Bitcoin shares signify investor preference for the leading cryptocurrency, which might be a deliberate strategy shift.

Trading Density above Par and Volume

The volume of traded bitcoins fell from 1.81 million BTC to 1.8 million BTC over a day’s period, making it down by 0.06%. This suggests that Bitcoin investors shift their funds from exchange wallets to personal wallets intending to hold rather than sell.

Also, trading volumes in futures have increased by 149.7%: Traders exchanged $141.79 billion in Binance’s futures markets just yesterday. The sudden rise suggests increasing trading activity and interest in Bitcoin, possibly leading to more volatility.

Read more:- The Best Dual Investment Platform

Derivatives Market And Funding Rates

Traders observed increased activity in derivatives, with higher interest in total options and CME BTC futures. These numbers suggest that traders are using Bitcoin for speculative purposes as well as hedging to limit risks.

Binance, Bybit, and OKX have different funding rates. Positive funding rates imply that long positions pay short ones, which means there is a bullish sentiment among the participants.

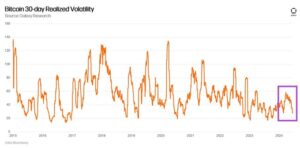

According to Paradigm, the crypto market is “slowing down” because “there are no novel and significant innovations.” Bob Loukas, a trader, observed Bitcoin in a declining phase, anticipating a potential drop before a bullish move to $60k.

Bitcoin Miners and Network Health

Yet, in general, bitcoin miners are always very critical as far as network health is concerned. This indicates that the mining activity has remained strong, which strengthens network defenses and transactions.

The miner’s revenue is their block rewards plus transaction fees that help them cater for their operational expenses while attracting more participation on the network.

At press time, the Bitcoin price had jumped to $66,608, an increase of 0.25% from its intra-day low. During the rally, BTC market cap rose by 148% to $1.31 trillion, with a 0.21% increase in the 24-hour trading volume to $30.25 billion.

Add a comment

You must be logged in to post a comment.