- March 12, 2025

- Posted by: Jackson Bennett

- Category: News

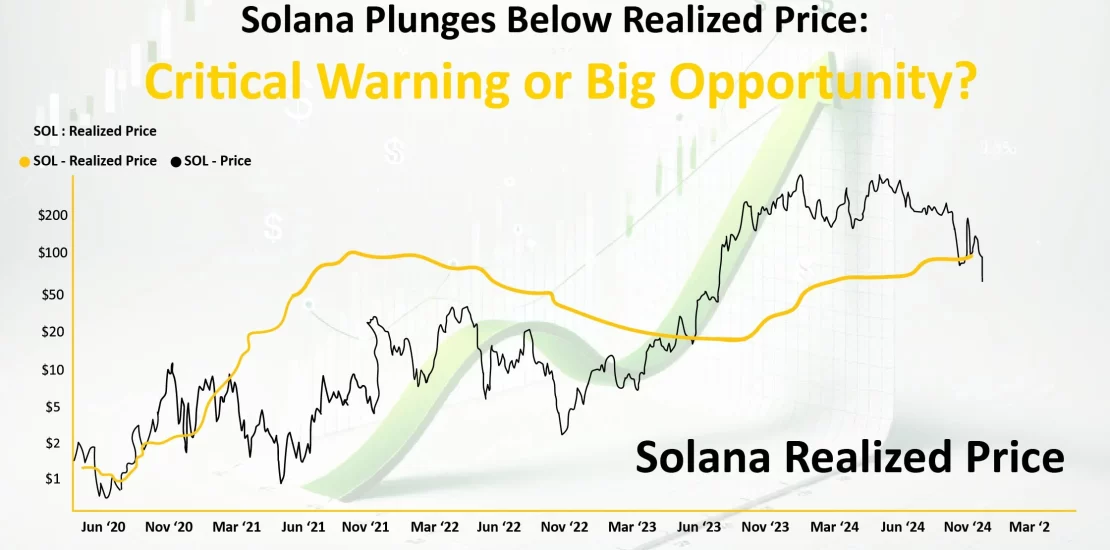

The Solana cryptocurrency market recorded a major price drop when SOL tokens fell below their Solana Realized Price after almost three years. Investors and analysts show strong interest in this event because it requires examinations of Solana’s outlook together with broad cryptocurrency system examinations.

Understanding Realized Price and Its Importance

A cryptocurrency network maintains its realized price metric as the average cost basis shown by all token movements in the system. Investors holding this asset have an average cost basis, which the Realized Price represents. The market price falling below the realized price level shows that investors have suffered losses across the board on average. The situation leads to market sentiment changes, which can produce additional selling pressure from investors who attempt to recover losses.

Solana’s Recent Price Movement

The Solana market value reached approximately $124 during March 11, 2025, while remaining below its Solana Realized Price of $134 at that time. SOL experienced its initial sub-realized price trade since May 2022 as the market price declined by 8%. The last crossover between the market price and realized price in 2022 marked the beginning of a bear market for cryptocurrency markets. The current drop below realized price currently worries investors and analysts since it might indicate an upcoming recurrence of past market conditions.

Historical Context and Implications

The market has used the realized price as an essential indicator to distinguish between upward and downward price movements in the past. The cryptocurrency market entered a prolonged period of decline for Solana after it exceeded its realized price in 2022. The current market price sitting under the previously recorded realized price creates potential for the pattern to take place again. The market forces currently attract both investors and analysts to track events that could indicate a new bear cycle for SOL.

Factors Contributing to the Decline

Several aspects have led to Solana’s falling market values.

- The network activity on Solana has demonstrated a substantial decrease because transaction fees fell to their lowest levels since the previous six months. Network service demand reduction indicators in Solana result in declining market value for the token.

- Market sentiment remains negative because regulatory pressures along with macroeconomic uncertainties and big market liquidations have affected the broader cryptocurrency market. Several negative influential factors have together weakened investor trust, thereby triggering broad-based digital asset market sell-offs, including those related to Solana Realized Price.

- The sale of 108688 SOL tokens worth USD 12.2 million Coin at $112.3 by a Solana whale resulted in a massive loss of $7.48 million. Large-scale asset selling operations produce supplementary downward pressure that affects market prices.

Comparative Analysis with Bitcoin

Prices which fall beneath actual market value occur in both Solana and other cryptocurrency markets. Recent negative market conditions have triggered losses in Bitcoin price, which resulted in negative value realization for its short-term holding investors. Solana Realized Price has also been affected, as short-term holder prices have fallen below market value because these investors purchased their coins less than six months ago. The average cost basis calculation shows their current loss. The current data points toward movement shifts within brief timeframes, and it demonstrates that the market contains bearish pattern sensitivities.

Potential Outcomes and Investor Considerations

When the realized price threshold gets broken, multiple situations are likely to develop:

- Losing shareholders might sell their assets at a reduced price, but this move would trigger more market value reductions.

- Investors who spot current prices as acquisition possibilities would increase their selection through accumulation, thus stabilizing price levels.

- Prices may consolidate during a sideways market movement because investors wait for obvious market directions.

- People who invest in this field should track market signals consisting of trading volumes, network data, alongside wider economic developments for smarter investment choices.

Caution or Opportunity?

The cryptocurrency community noticed the significant decrease of Solana beneath its Solana Realized Price. The current market conditions require a detailed examination of potential bearish trends despite past market indicators pointing to negative developments. The market requires investor attentiveness while they analyze both economic trends and network performance metrics to maintain sustainable investment decisions.

Add a comment

You must be logged in to post a comment.