- June 19, 2024

- Posted by: Jackson Bennett

- Category: News

According to market analyst Ali Martinez, the Bitcoin ETF price top could be delayed until later this year.

Bitwise amended the S-1 of its Ethereum ETF after consulting with the SEC. This disclosed a $2.5 million seed investment and Pantera Capital’s interest.

HIGHLIGHTS

- Bitcoin Drawdown Persists Amidst Spot ETF Sell-offs.

- Market analyst Ali Martinez predicts a cycle top in Q4.

- That projection is based on historical patterns and aligns with expert predictions so far.

The past week has seen the bitcoin price maintain its bearish drawdown. While it aims to initiate a rebound, senior market analyst Ali Martinez has provided key takeaways.

Read more:– 3 Reasons Why Key Bitcoin Metrics Are Rising Sharply Today

Historic Cycles of Bitcoin Bull Run

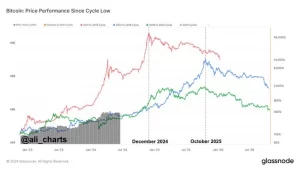

The analyst handed out charts that explained Bitcoin’s performance from cycle lows over different periods. Precisely, the chart outlines cycles from 2011 to 2015, 2015 to 2018, 2018 to 2022, and 2022+.

In these cycles, Bitcoin prices fluctuated wildly, although some noted that they had hit all-time highs at certain points.

Martinez is of the opinion that a bullish run could occur in the market leading to December 2024 and October 2025 if Bitcoin’s present cycle reflects the last three cycles. The analysis has some basis in past predictions from professionals in this industry.

Bitcoin wallet and payment application: Strike’s CEO, Jack Mallers, said Bitcoin could rise by between 260% and 1,357% in the next few months. He, however, believes that it still remains a new currency and therefore expects it to get to $250,000–$1,000,000 within the next 10-18 months.

Bernstein also predicted BTC hitting $200,000 by 2025, while more audaciously, an analyst at the firm pointed out that an eventual price of up to one million dollars was plausible for the flagship cryptocurrency by 2033.

Bearish Movement in BTC Price

Bearish Movement in BTC Price

In contrast, there has been a bearish trend for this coin over a period of time. Currently, as of the writing of this article, bitcoin trades at $64,494.51, reflecting a -2.70% change within the last day’s trading session.

On its way down to the support level of the moving average (50), which indicates a short-term downtrend inside crypto, Bitcoin dropped down towards its month-long low.

Hope is high for a Bitcoin ETF boost to drive a substantial value rise.

Although this bullish trend exists, the current market conditions could hinder such a forward-looking scenario in the spot BTC ETF market.

All in all, the Bitcoin ETF market stinks, and outflows are standing firm for it. Recent data from Farside Investors revealed a solid net outflow of $226.2 million from the US Bitcoin spot ETF market. Moreover, Farside also revealed an inversely proportional $146 million net outflow from the offering.

Add a comment

You must be logged in to post a comment.

Bearish Movement in BTC Price

Bearish Movement in BTC Price